📊 CrewAI with MCP Tool: Analyzing Nifty 50’s Day-wise Overnight Performance

Published by TechToGeek.com

Table of Contents

🌅 Introduction

Market data is more than numbers — it’s the story of trader behavior, risk appetite, and timing. In this post, we explore Nifty 50’s overnight performance day-by-day using a Python analysis script generated with help from Claude, our AI assistant.

The project merges data science and Agentic AI thinking, where automation and reasoning coexist — much like in modern frameworks such as CrewAI with MCP tool, which enable autonomous AI agents to perform real-world analysis, gather data, and deliver actionable insights.

This blog breaks down:

- 📈 How the overnight performance of Nifty 50 behaves across weekdays

- 🧠 The logic and code behind the Python script

- 💡 What this means for option traders (PE vs CE bias)

- 📚 Four must-read books to deepen your stock-market knowledge

⚙️ Understanding the Code (nifty_overnight.py)

The Python script is a simple yet powerful tool. It:

- Downloads historical Nifty 50 data via

yfinance. - Calculates overnight return = (

Open – Previous Close) /Previous Close × 100. - Groups results by weekday.

- Visualizes the data in a bar chart (see below).

- Exports the analysis to CSV for further research.

Here’s a core snippet:

nifty['Prev_Close'] = nifty['Close'].shift(1)

nifty['Overnight_Return'] = ((nifty['Open'] - nifty['Prev_Close']) / nifty['Prev_Close']) * 100

nifty['Day_of_Week'] = nifty.index.day_name()

day_analysis = nifty.groupby('Day_of_Week')['Overnight_Return'].mean()

day_analysis = day_analysis.reindex(['Monday', 'Tuesday', 'Wednesday', 'Thursday', 'Friday'])

This automation reflects the CrewAI with MCP tool mindset — intelligent scripts that autonomously fetch, process, and visualize live data, freeing traders from manual effort.

📊 Interpreting the Chart

From 01-Jan-2019 to 13-Nov-2025, here’s what the analysis reveals:

| Day | Avg Overnight Return (%) |

|---|---|

| Monday | 0.0584 % |

| Tuesday | 0.2267 % |

| Wednesday | 0.1429 % |

| Thursday | 0.0843 % |

| Friday | 0.0765 % |

📈 Tuesday – The Star Performer

The data clearly shows that Tuesday has the highest average overnight gain (0.2267 %), suggesting strong buying optimism early in the week.

🧭 Wednesday – Mid-Week Momentum

With 0.1429 %, Wednesday often extends Tuesday’s sentiment, signaling confidence carry-through.

🌧 Monday – Soft Start

Mondays open with only 0.0584 %, implying cautious weekend sentiment or global-market digestion.

🔻 Thursday & Friday – Profit Booking Zone

Late-week returns dip, as traders reduce exposure before the weekend — a typical pattern across global indices.

💬 What Does This Mean for Option Traders?

Let’s connect this data to options trading strategy. Overnight returns directly affect the opening gap, influencing both Call (CE) and Put (PE) buyers.

🟢 1. Buying CE (Call Options) Bias

Higher average overnight returns indicate that markets tend to open higher than the previous close.

👉 Therefore, for positional overnight trades, buying CEs (Calls) may have an edge — especially on Tuesdays and Wednesdays.

🔴 2. Buying PE (Put Options) Bias

Conversely, Monday and Friday show relatively lower or weaker returns — days when minor negative openings or flat moves are common.

👉 Hence, buying PEs could work better as short-term hedges late in the week.

💡 3. Strategic Insight

This doesn’t mean blindly buying options based on weekday, but rather timing exposure to maximize overnight gaps. Combining this insight with implied-volatility and event filters (like FII activity or global cues) can refine setups.

In simple terms:

📅 Tuesday = Momentum Day; Friday = Caution Day.

That’s the power of blending quantitative data and Agentic AI thinking inspired by CrewAI with MCP tool — letting your system observe, learn, and adapt.

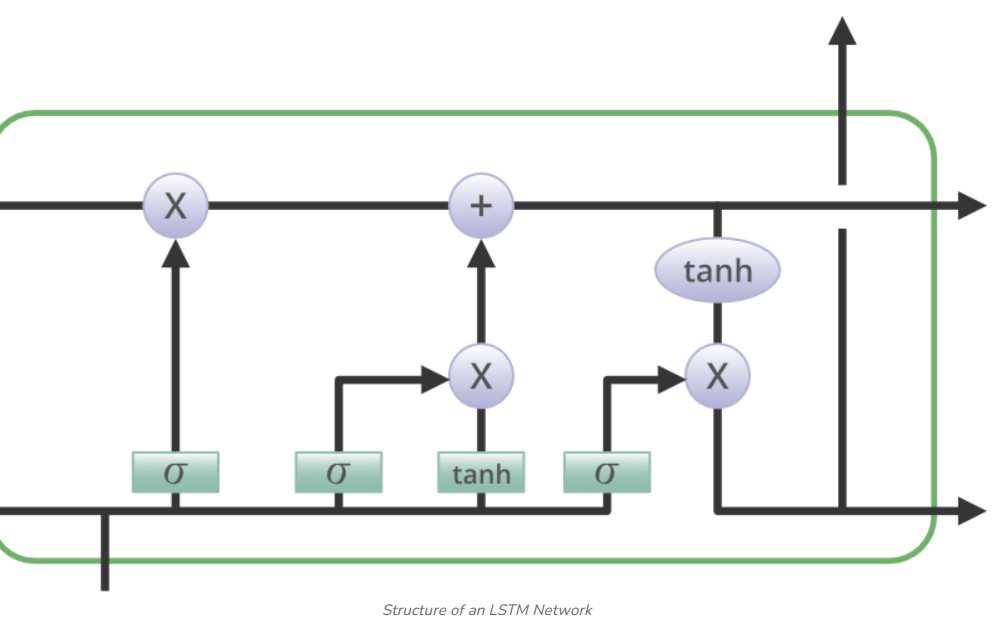

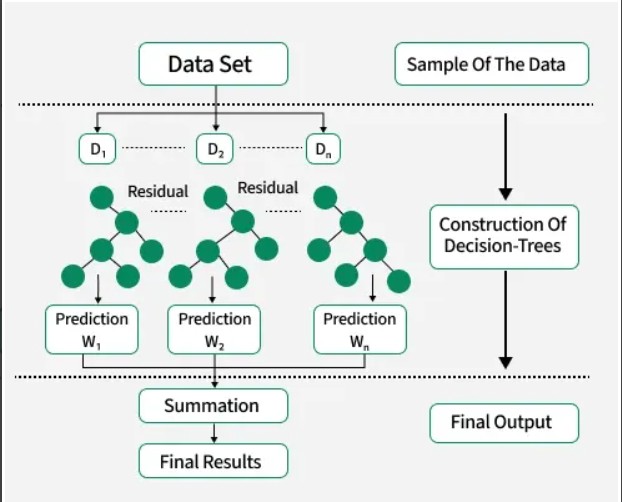

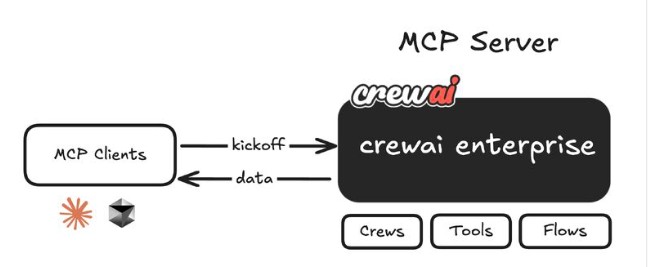

🧠 How “CrewAI with MCP Tool” Connects

The CrewAI with MCP tool represents the next evolution of data-driven automation.

While our script uses pandas and matplotlib, imagine extending it through CrewAI agents:

- One agent fetching live market data.

- Another analyzing overnight gaps using MCP-enabled logic.

- A third summarizing insights in natural language for traders.

That’s not fiction — CrewAI with MCP tool makes this architecture real. It turns standalone scripts into interconnected, autonomous agents capable of running full analyses and producing trade signals intelligently.

🧩 Example Flow

from crewai import Agent, Crew

from mcp_tool import MarketFetcher

fetcher = MarketFetcher(symbol="^NSEI")

analysis_agent = Agent(name="OvernightAnalyzer", tools=[fetcher])

crew = Crew(agents=[analysis_agent])

crew.run("Analyze Nifty overnight performance by weekday")

This is how an Agentic workflow would replicate our nifty script — using CrewAI with MCP tool to orchestrate data retrieval and decision-making in real time.

🧾 Data Insights & Interpretation

- Positive Overnight Bias

Over 60 % of trading days opened higher, confirming the “overnight optimism” effect. - Tuesday Alpha

Likely driven by post-Monday positioning, algorithmic inflows, or positive global cues. - Volatility Compression Toward Friday

Lower late-week averages suggest defensive positioning and volatility decay before expiry. - Standard Deviation

Tuesday and Wednesday also exhibit higher variability — good for traders who thrive on movement.

📚 Top 4 Books for Market Learners (With Affiliate Links)

Knowledge compounds faster than money. These books are perfect for readers eager to deepen their understanding of technical and quantitative trading.

1️⃣ Indian Stock Market by Pankaj Ladha & Anant Ladha

A crisp and practical guide to Indian equities. It explains market structure, F&O, and investor psychology clearly. Ideal for beginners building a solid foundation in Indian markets.

Mini Review: Clear, data-backed, and relatable. Great for those new to Indian exchanges.

2️⃣ 51 Trading Strategies by Aseem Singhal

Packed with actionable ideas across momentum, reversal, and breakout setups. Perfect for system traders who wish to back-test new ideas (like our overnight-gap strategy).

Mini Review: Concise, practical, and algorithm-friendly — a must-read for traders who think quantitatively.

3️⃣ Zebra Learn Finance Bundle by Zebra Learn

A comprehensive online-learning kit covering fundamental analysis, portfolio building, and options. Excellent for students and self-learners.

Mini Review: Engaging, visual, and interactive. Perfect for Gen Z investors learning financial independence.

4️⃣ Price Action Trading by Sunil Gurjar (ChartMojo)

A trader’s favorite. This book focuses on price-action setups that align perfectly with Nifty’s intraday and overnight behavior.

Mini Review: Real-market wisdom + clear charts = pure gold for technical traders.

🧮 Summary of Findings

| Insight | Observation |

|---|---|

| Best Overnight Day | Tuesday (0.2267 %) |

| Weakest Day | Monday (0.0584 %) |

| Option Bias | Buy CE early week, PE late week |

| Market Mood | Optimistic mid-week → cautious weekend |

| Back-test Window | 01-Jan-2019 to 13-Nov-2025 |

| Toolset | Python, Pandas, Matplotlib + CrewAI with MCP tool concept |

🧠 Key Takeaways

- Tuesday rules the gap! Historical data shows it’s the most bullish day overnight.

- Integrate automation. Agentic frameworks like CrewAI with MCP tool can continually monitor and update such analyses.

- Strategy > Prediction. Let data shape your approach — not bias.

- Education compounds. Reading the recommended books builds the context for interpreting these numbers meaningfully.

❓ FAQ

Q1. What does “overnight return” mean?

It’s the % change between the previous day’s close and the next day’s open.

Q2. Why is Tuesday’s performance the highest?

Possibly due to post-Monday adjustments, global recovery rallies, and short-covering.

Q3. Is buying CE always profitable overnight?

Not always — but data favors CE bias early in the week. Combine this with IV data before trading.

Q4. Can I automate this analysis?

Yes — using Python scripts like this or through CrewAI with MCP tool to create autonomous agents fetching and analyzing live market data.

Q5. Why use CrewAI with MCP tool for trading analytics?

It enables multi-agent intelligence — data gathering, analysis, and reporting — without constant human supervision.

🏁 Conclusion

The Nifty 50’s overnight behavior shows a clear bullish tilt mid-week, offering actionable insights for both discretionary and quantitative traders.

With tools like Python and frameworks like CrewAI with MCP tool, the modern trader can move beyond static analysis — into a world where intelligent agents track patterns, learn continuously, and deliver insights autonomously.

By combining data, AI frameworks, and quality learning resources, you can trade smarter, not harder.