TradingAgents Using Crew: Revolutionizing Algorithmic Trading with AI

Algorithmic trading has evolved rapidly over the past decade, and the introduction of AI-driven agents has pushed it into a new era. Among the most exciting innovations is the concept of TradingAgents powered by CrewAI, which combines the intelligence of Large Language Models (LLMs) with autonomous task execution to create agents that can analyze, decide, and act in financial markets. In this article, we’ll explore what TradingAgents are, how Crew facilitates them, and how traders and developers can leverage this technology for smarter trading strategies.

Table of Contents

What Are TradingAgents Using Crew?

TradingAgents are AI-powered entities designed to make trading decisions automatically. Unlike traditional algorithmic trading scripts, which execute pre-defined rules, TradingAgents leverage machine learning, AI reasoning, and real-time data analysis to adapt and respond to market conditions.

Key characteristics of TradingAgents include:

- Autonomy: They can execute trades independently without human intervention.

- Intelligence: Powered by LLMs or other AI models, they can interpret complex market data.

- Adaptability: Agents can learn from past trades and optimize strategies over time.

- Integration: They can connect to APIs (like Angel One or Interactive Brokers) to fetch live data and execute trades.

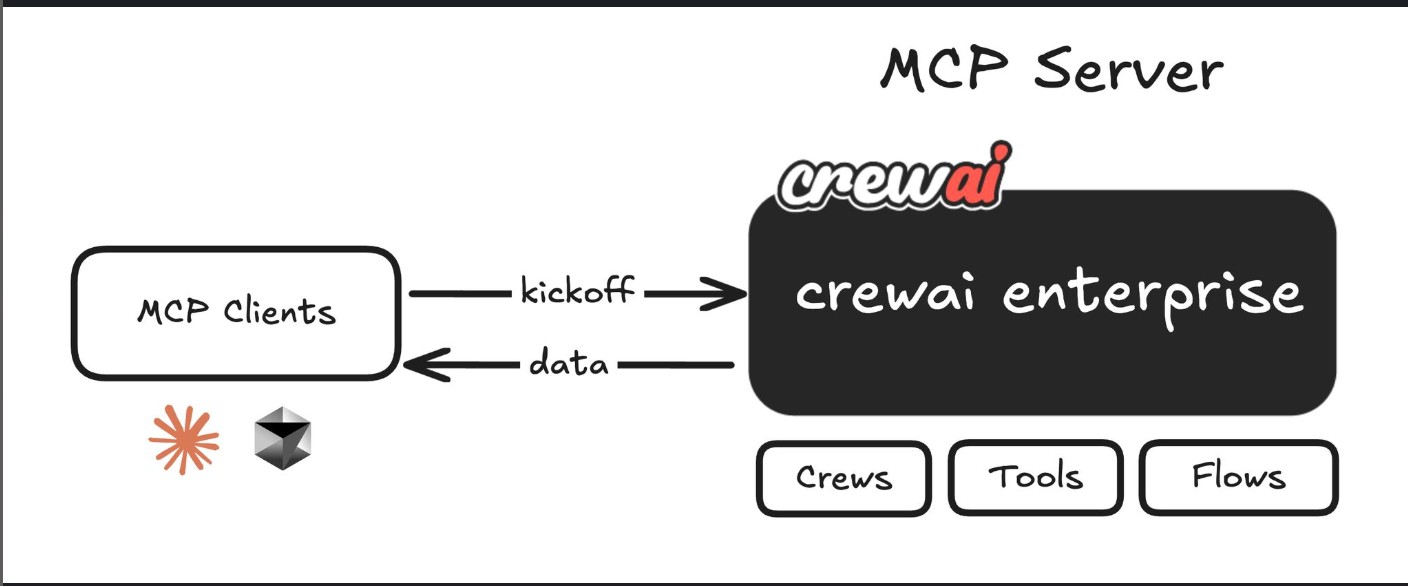

CrewAI: The Backbone of Intelligent TradingAgents

CrewAI is a framework that allows developers to create teams of AI agents that collaborate to achieve complex goals. In the context of trading, CrewAI enables the development of TradingAgents that can operate as a coordinated system, where each agent has a specific role, such as market analysis, risk management, or trade execution.

Core Features of CrewAI

- Agents as Autonomous Units:

Each agent has a role, goal, and optional tools. For instance:- An

analyst_agentcan interpret market trends using historical OHLC data. - A

trader_agentcan execute buy/sell orders based on analysis.

- An

- Task Management:

CrewAI organizes complex workflows into tasks. Each task can have dependencies, allowing one agent’s output to feed into another agent’s input. - Tool Integration:

Agents can use APIs, spreadsheets, databases, or any external tools. This makes them capable of not just reasoning but also taking action in real-world environments. - Memory & Learning:

Agents can maintain a memory of past interactions and decisions, allowing continuous improvement.

How TradingAgents Work Using CrewAI

Let’s take an example workflow for a Nifty50 trading agent system:

- Data Collection:

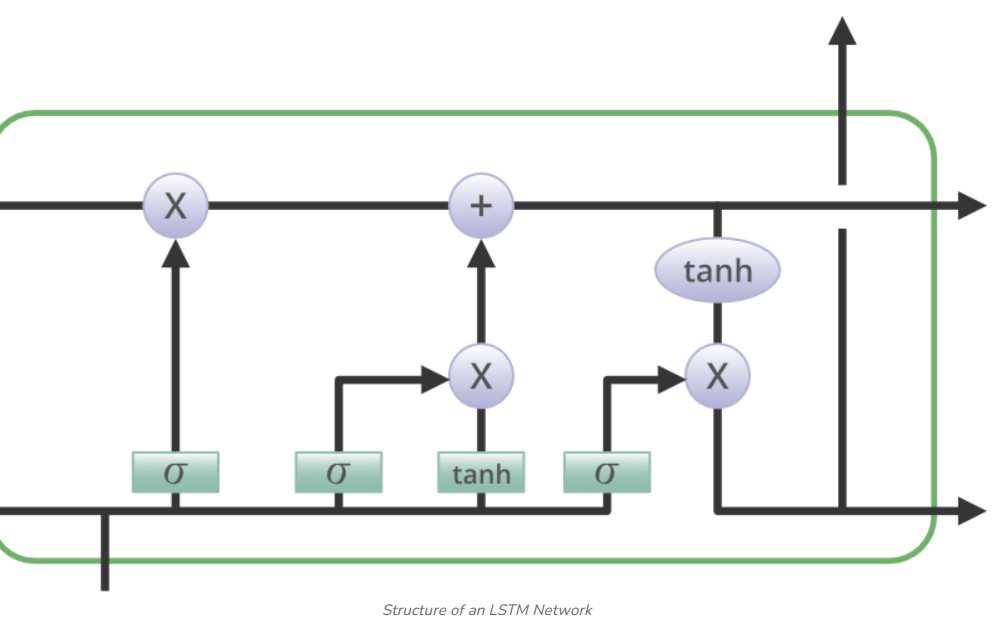

An agent fetches historical 5-minute OHLC (Open, High, Low, Close) data from the Angel One API.data = fetch_nifty50_data(interval="5m", period="3y") - Market Analysis:

Theanalyst_agentanalyzes the data using an LSTM or CNN-LSTM model to identify trends or patterns.trend = analyst_agent.run(get_stock_analysis, data) - Decision Making:

Based on analysis, thetrader_agentdecides whether to buy, sell, or hold. CrewAI allows you to set rules or thresholds for action or let the LLM decide autonomously.action = trader_agent.run(trade_decision, trend) - Execution:

The agent executes trades via API integration. CrewAI ensures safe execution and logging. - Feedback & Learning:

Agents store results in memory for future learning, enabling smarter decisions over time.

This end-to-end automation is what differentiates TradingAgents from traditional trading scripts. The key is the collaborative workflow enabled by CrewAI.

Benefits of Using TradingAgents with CrewAI

- Increased Efficiency:

TradingAgents can monitor markets 24/7, execute trades instantly, and handle multiple assets simultaneously. - Reduced Human Bias:

Traditional trading often suffers from emotional or psychological biases. AI agents make data-driven decisions without fear or greed. - Customizable Strategies:

Developers can design agents with specific strategies like scalping, swing trading, or trend following. Each agent can specialize in one aspect, allowing a coordinated approach. - Scalable and Modular:

CrewAI’s modular design allows new agents or tasks to be added without rewriting the entire system. - Transparency & Logging:

CrewAI’s verbose mode logs agent actions and reasoning, providing transparency and auditability for compliance or optimization.

Real-World Example: Building a Simple TradingAgent Crew

Here’s a simplified code example of setting up a TradingAgent system with CrewAI:

from crewai import Crew, Agent, Task

# Define agents

analyst_agent = Agent(

role="Stock Analyst",

goal="Analyze Nifty50 market trends and summarize insights"

)

trader_agent = Agent(

role="Trader",

goal="Decide buy/sell actions based on analyst insights and execute trades"

)

# Define tasks

get_stock_analysis = Task(

description="Analyze 5-min OHLC data to identify trends",

agent=analyst_agent

)

trade_decision = Task(

description="Decide and execute trade orders",

agent=trader_agent,

depends_on=[get_stock_analysis]

)

# Create Crew

stock_crew = Crew(

agents=[analyst_agent, trader_agent],

tasks=[get_stock_analysis, trade_decision],

verbose=True

)

# Run Crew

stock_crew.run()

How this works:

analyst_agentanalyzes market data.trader_agentuses that analysis to make decisions.- CrewAI ensures the workflow runs in the correct order and logs every step.

Tips for Optimizing TradingAgents

- Use Reliable Data Sources:

The agent’s performance depends heavily on the quality of historical and real-time market data. - Incorporate Risk Management:

TradingAgents should include stop-loss, position sizing, and diversification logic. - Test in a Sandbox:

Always backtest strategies and run agents in paper trading before going live. - Combine ML Models:

Use hybrid models like CNN-LSTM or attention-based models for better predictions. - Monitor Performance:

CrewAI allows verbose logging. Regularly review agent decisions to detect anomalies or improve strategies.

Future of TradingAgents with CrewAI

The future of algorithmic trading is moving toward fully autonomous AI systems. TradingAgents can potentially:

- Monitor multiple markets simultaneously

- Adapt strategies in real-time based on market volatility

- Communicate with other AI agents to form a collaborative trading network

- Automate portfolio rebalancing and tax optimization

CrewAI provides the infrastructure to turn this vision into reality, combining LLM reasoning, autonomous execution, and task orchestration in one platform.

Common Misconceptions

- “TradingAgents are like robots that guarantee profits.”

❌ Reality: They are tools that execute data-driven strategies. Success depends on model quality, market conditions, and risk management. - “CrewAI replaces human traders entirely.”

❌ Reality: CrewAI augments human traders by automating repetitive tasks and providing actionable insights. - “Once deployed, no monitoring is needed.”

❌ Reality: Market conditions change rapidly. Continuous monitoring and strategy updates are essential.

Getting Started

- Install CrewAI:

pip install crewai - Set Up Your Project Structure:

my_trading_agents/ ├── crew.py ├── agents/ ├── tasks/ ├── tools/ - Define Agents and Tasks:

Start small — one analyst agent and one trader agent. - Backtest & Deploy:

Test with historical data first, then move to paper trading. - Iterate:

Improve models, add agents for risk management, or integrate additional APIs.

Conclusion

TradingAgents using CrewAI represent a significant leap in algorithmic trading. By combining autonomous agents, LLM reasoning, and tool integration, traders and developers can build systems that analyze, decide, and act faster than ever before.

CrewAI provides the structure, orchestration, and intelligence needed to turn AI into a practical trading companion, helping traders reduce manual effort, minimize emotional bias, and scale strategies across multiple markets.

Whether you’re a seasoned quant trader or a developer exploring AI automation, TradingAgents powered by CrewAI offer a robust and flexible way to modernize your trading workflows.

Here you can the get the github link